RETURN TO FLOODPLAIN MANAGEMENT HOME

The 100-year floodplain is the area that has a 1% chance of flooding annually. This means your property has a 26% chance of flooding over the life of a 30-year mortgage. Smaller floods have a greater chance of occurring in any year and can still create a significant flood hazard to you and your property.

In an effort to make affordable flood insurance more available, the National Flood Insurance Program (NFIP) a program administered by the Federal Emergency Management Agency (FEMA) was established in 1968 by Congress. The NFIP is a Federal program created by Congress to mitigate future flood losses nationwide through sound, community-enforced building and zoning ordinances and to provide access to affordable, federally backed flood insurance protection for property owners. The NFIP is designed to provide an insurance alternative to disaster assistance to meet the escalating costs of repairing damage to buildings and their contents caused by floods.

Participation in the NFIP is based on an agreement between local communities and the Federal Government that states that if a community will adopt and enforce a floodplain management ordinance to reduce future flood risks to new construction in Special Flood Hazard Areas (SFHAs), the Federal Government will make flood insurance available within the community as a financial protection against flood losses.

On March 16, 1981 the City of Birmingham became an NFIP Community to make flood insurance available to Birmingham residents. Since 1981, the City has satisfied the minimum NFIP participation requirements and the opportunity for Birmingham residents to obtain flood insurance still remains.

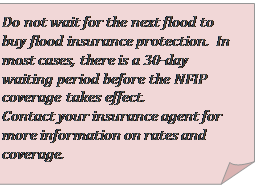

If you purchase a home in a FEMA designated SFHA with a mortgage loan from a Federally-regulated lender, by law your lender must make certain that you obtain flood insurance and renew it yearly. In such cases as these, you will not have to wait 30 days before your policy takes effect, it becomes effective immediately. You may want to ask your mortgage company about escrowing your premium (i.e. paying a fixed monthly amount towards your premium costs).

Flood Insurance

- Homeowner’s insurance policies DO NOT cover damage from floods. However, because the City of Birmingham participates in the National Flood Insurance Program (NFIP), you can purchase a separate flood insurance policy. This flood insurance is backed by the Federal government and is available to everyone, even properties that have been flooded.

- Any area that is NOT mapped as a Special Flood Hazard Area (SFHA) may qualify for a lower-cost with FEMA’s Risk 2.0.

- The City of Birmingham participates in the NFIPs Community Rating System (CRS) and is currently at a Class 5. Therefore, all locations within a SFHA will receive a flood insurance premium reduction of 25% and all locations that are NOT within a SFHA will receive a flood insurance premium reduction of 10%.

- Some people have purchased flood insurance because it was required by the bank for a mortgage or home improvement loan. Usually these policies only cover the building’s structure and not the contents. Due to the flooding that happens in your area, there is usually more damage to the furniture and contents than there is to the structure. Please be sure you have contents coverage.

- If you are a tenant, it is wise to insure your contents. The policy premium is based on several factors, including the flood risk of the building that you occupy.

Community Rating System (CRS)

In order to save our residents money we participate in the Community Rating System Program through The National Flood Insurance Program’s (NFIP). CRS is a voluntary incentive program that recognizes and encourages community floodplain management activities that exceed the minimum NFIP requirements.

As a result, flood insurance premium rates are discounted to reflect the reduced flood risk resulting from the community actions meeting the three goals of the CRS:

- Reduce flood damage to insurable property;

- Strengthen and support the insurance aspects of the NFIP, and

- Encourage a comprehensive approach to floodplain management.

The Community Rating System (CRS) recognizes and encourages community floodplain management activities that exceed the minimum NFIP standards. Depending upon the level of participation, flood insurance premium rates for policyholders can be reduced up to 45%. Besides the benefit of reduced insurance rates, CRS floodplain management activities enhance public safety, reduce damages to property and public infrastructure, avoid economic disruption and losses, reduce human suffering, and protect the environment. Participating in the CRS provides an incentive to maintaining and improving a community’s floodplain management program over the years. Implementing some CRS activities can help projects qualify for certain other Federal assistance programs.

Flood Insurance Discount

To encourage and reward communities that exceed the minimum NFIP requirements, the Community Rating System Program (CRS) was established in 1990. The CRS is a voluntary program under the National Flood Insurance Program that makes available to the residents of participating communities flood insurance discounts ranging from 5% to 45% based upon the Community establishing floodplain management programs that exceed the minimum NFIP requirements. The City of Birmingham has been a CRS Community since December 1993 and is the only CRS Class 5 CRS rated Communities in the State of Alabama, affording to Birmingham residents 25% savings in flood insurance premium costs. On average, this savings is approximately $100 to $200. When purchasing flood insurance, please do not forget to ask the agent about your 25% CRS Discount.

Flood Insurance Cost

The price of a flood insurance policy varies and depends mostly on where a property is located, (flood zone), coverage type and amount of coverage. In high risk flood zones, where coverage is often mandatory, policies generally cost more. In 2014 on average, the cost of a flood insurance policy for $100,000 in premium coverage on a house located in a high risk flood zone was about $800 per year. However, due to recent flood insurance reform, this amount may not reflect current flood insurance costs. In low to moderate risk flood zones, where the risk of flooding is still moderately high, lower cost flood insurance options are available. If your property is located in a low to moderate risk flood zone, you should consider purchasing the lower cost flood insurance. According to FEMA, approximately 20-25 percent of all flood insurance claims are filed for properties located in low to moderate risk areas.

Flood insurance protects your home. Before you purchase flood insurance to protect your home, you’ll need to find an agent who services the Birmingham area. For an agent within The City of Birmingham, please go to www.floodsmart.gov/flood-insurance-provider

Additional Tips and Information

In order to avoid a delayed recovery process:

- Don’t wait until a flood event occurs before you purchase your policy. Just because you haven’t experienced a flood yet, doesn’t mean you never will. Visit www.floodsmart.gov to familiarize yourself with the NFIP.

- Contact the NFIP at (888) 379-9531 to locate licensed insurance agents in your community or referrals of licensed flood insurance agents.

- If you receive federal disaster assistance after a flood, flood insurance purchase is mandatory in order to receive further assistance from FEMA.

- If your home, apartment or business flooded and you didn’t have flood insurance at that time, you still can obtain flood insurance. Contact Floodplain Management Program Staff at (205) 254-2479 to find out technical information on flood insurance and if your property is located in a low or high risk flood zone.